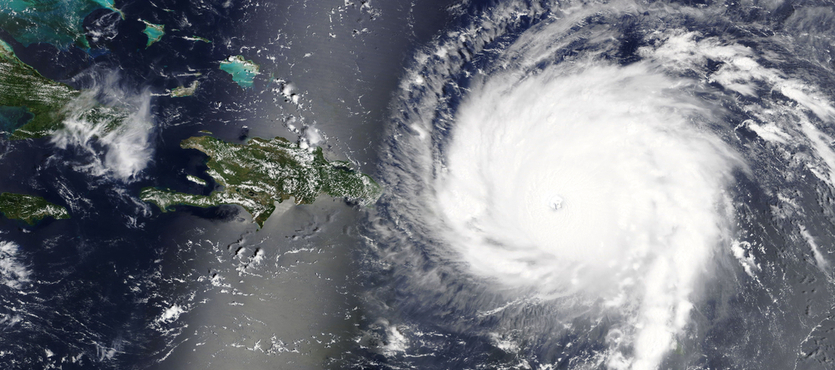

With hurricane season kicking into gear, it is important to be prepared financially for a major storm or emergency event. During the 2017 hurricane season, the southeast saw three major hurricanes, Harvey, Irma, and Maria, and they caused an estimated $67 billion in damages in less than 30 days. The hurricane season is not expected to be any less damaging this year, with forecasters calling for an above average 2018 hurricane season.

Unfortunately, as the Sunshine state’s residents emerged from their homes after the storms hit and began to take account of the damages, many found themselves unfamiliar with the insurance claim process. While the claim process can be confusing, even many of those who understood the process were left stranded by their insurance companies, resulting in nearly 11,000 lawsuits against insurance companies filed between January and March.

While we would like to believe that the insurance companies are on our side, that is not necessarily the case. They are designed to minimize and deny your claims for damages. This means that you might need assistance in getting your claims paid. Below are some things that you should know if and when you ever need to file an insurance claim for hurricane damage:

Your Initial Contact with The Insurance Company Could Determine if Your Claim is Paid or Denied

As a general rule, insurance adjusters are trained to pay claims for the smallest amount possible or deny the claim outright, if possible. This process begins from the moment you call them the very first time to report your claim. During this conversation, it is understandable that you could be under a lot of anxiety and stress from your losses, but keep in mind that every answer you give the adjuster will be recorded and will help determine if your losses will be covered. The insurance company does not take into consideration that you were upset and under a lot of stress. They will use your confusion and frustration against you without hesitation. If at all possible, if you are determined to contact your insurance company directly, try to contact them in writing rather than on the phone.

Structural Damage to Your Home Should be Covered by the Part of Your Policy That Covers Windstorms if the Hurricane was Named

If a hurricane that has been named causes damage to your home, all wind losses are treated as a hurricane loss under Florida Statute. This coverage is defined as cover for damages or loss resulting from the peril of a windstorm during hurricanes. Loss includes damage to the interior and exterior of the building caused by snow, hail, rain, sleet, dust, or sand if the force of the wind damages the building, creating an opening to the interior. This coverage also includes tornadoes that are spawned from the named hurricane.

Never Provide Sworn Statements to an Insurance Agent or Company Before Consulting With an Attorney

Insurance policies in Florida have what are called “cooperation clauses,” which have numerous conditions that can result in your claim being underpaid or even denied. One of the conditions is a requirement for “Examination Under Oath” at the insurance company’s request. This is a sworn statement conducted in front of a court reporter where the agent or the company’s defense attorney will question the insured. The questions are often complex and confusing and will be used against you to lower the amount that is paid on your claim or deny it. While you are required to attend these sessions, you should tell them that you would like to appear with an attorney.

You Should Always Respond to Your Insurance Company’s Request for Information

Another requirement of the “cooperation clause” is that you have to cooperate with the insurance company when they ask you for information. You will often receive a letter requesting more information before they will pay your claim, and if you fail to reply, it gives them grounds to deny your claim. You must respond to the letters, but if you need additional time to reply, respond to them with a letter telling them you are willing to cooperate, but that you need more time and then respond with the needed information as soon as possible. Remember that anything you say could be used against you by the company later on.

If You Hire an Attorney Due to Your Claim Being Denied or Underpaid, Florida Law Says the Insurance Company Must Pay Your Attorney Fees if You Win Your Case

According to Florida statutes, the company will be ordered to pay any reasonable attorney fees and costs related to the case if you prevail in your claim. This prevents the insurance company from taking advantage of customers by failing to properly pay claims.

Insurance Companies Must Replace Your Lost Property with Items That are Similar in Like, Quality, and Kind

If your insurance policy has coverage for loss of personal property like appliances, electronics, and other similar items, they are typically required to replace or reimburse you for items of the same kind, like, and quality. For example, if you had a name brand television, the insurance company couldn not replace it with a no-name Walmart brand television. This is why it is important when you create a list of your lost property that you include the model, make, and expense of each item.

Damages Resulting from Flooding or a Hurricane or Tropical Storm Surge are Not Usually Covered by Windstorm Policies

After the Federal National Flood Insurance Act was implemented in 1968, the windstorm portion of homeowner policies no longer provided coverage for storm surge and flooding loss. Instead, these losses are covered by the Federal Flood Insurance Program. In Florida, this may also include rainwater if the water falls to the ground and then floods your home.

How Hiring an Experienced Attorney can Help

When it comes to dealing with the aftermath of a hurricane, you need to know your rights and be able to protect yourself because the insurance company may not be on your side the way you had hoped. Keep in mind that your family and health should be your top priority, but protecting your home and possessions is important, as well. The attorneys at Brill & Rinaldi, The Law Firm, have years of experiencing handling hurricane claims and can help you protect your rights and get the compensation for your claim that you are entitled to by law. Contact them today for a consultation.